Joël here! 👋

It’s been a while since I last wrote about AI.

Today is not going to be another review of agentic browsers or how AI and Bitcoin could work together.

No, today I want to talk about the AI bubble as a whole.

It basically functions as an ever-growing circle jerk between a few companies.

NVIDIA, Oracle, and OpenAI are the leading players who’re issuing money back and forth without any consequences.

Today, I want to tackle the question of when this bubble will burst and how similar it is to the Dot-Com bubble.

Spoiler ahead, I will sound like a doomsday, black swan lunatic, but there is a lot of stuff to worry about.

Anyway, let’s get stuck in!

The PayPal Mafia Was Replaced by the AI Mafia

If you’ve been following the tech scene long enough, you know about the PayPal mafia.

It’s a group of individuals (including Peter Thiel, David Sack, and Elon Musk, among others) who were part of PayPal’s early success.

PayPal was the first major Internet disruptor to enable online payments, and all those involved emerged as influential figures in Silicon Valley, the tech scene, and politics.

The same is happening with AI, where a mafia is forming as well.

It consists of:

Sam Altman from OpenAI

Jen-Hsun Huang from NVIDIA

Larry Ellison from Oracle

All of these companies are either key infrastructure players, mainly Oracle and NVIDIA, or build the world’s largest LLMs (OpenAI).

Gordon Gecko taught us that money and especially greed are good, and it is that greed that is blowing up the AI bubble.

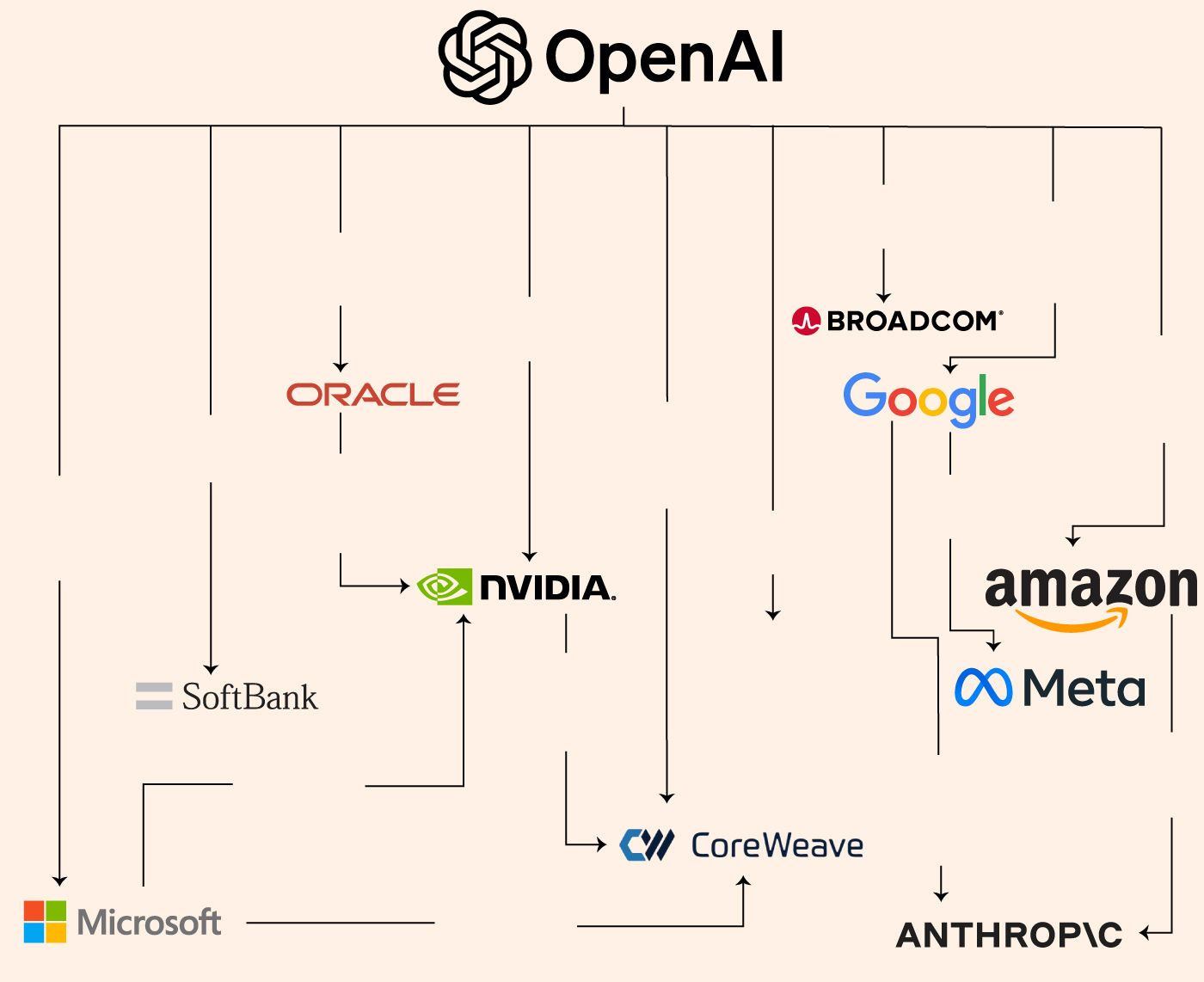

Source: FT

As you can see in the Financial Times image above, there is a system behind the ever-increasing evaluations of all AI players, especially OpenAI.

The playbook is as follows:

OpenAI announces a new model or update.

Through clever marketing, they push the update as revolutionary.

For it to work, they need infrastructure partners.

This is where NVIDIA comes in with new chips and boards.

Both companies help each other out.

But you need cloud infrastructure to deploy, enter Oracle.

They partner up with OpenAI and NVIDIA.

All three companies make deals or loans to each other.

The space grows until OpenAI announces a new update.

And the cycle repeats…

All companies either have loans or contracts with each other, and there are promises that all of these will be repaid if OpenAI reaches a certain revenue threshold.

That threshold is currently set at $1 trillion by 2027, and OpenAI is “only” at $14 billion in revenue.

On paper, things could work out, and tech is constantly growing exponentially, but there is a lot of room left for OpenAI to grow and fulfill its duties.

And this is just a handful of companies that I mentioned. There are even more outside players, including Broadcom, Google, and investment funds such as SoftBank.

All of them bet on one player and one market situation: that OpenAI will continue on its trajectory and that nothing will get in the way.

The Cracks Are Beginning to Show…

While the mechanism Sam Altman has built has been impressive and is surely working for OpenAI currently, amid a lot of hype, cracks are showing.

Especially if you look at the stock prices and evolution of all players involved since the mega deals were announced earlier this year.

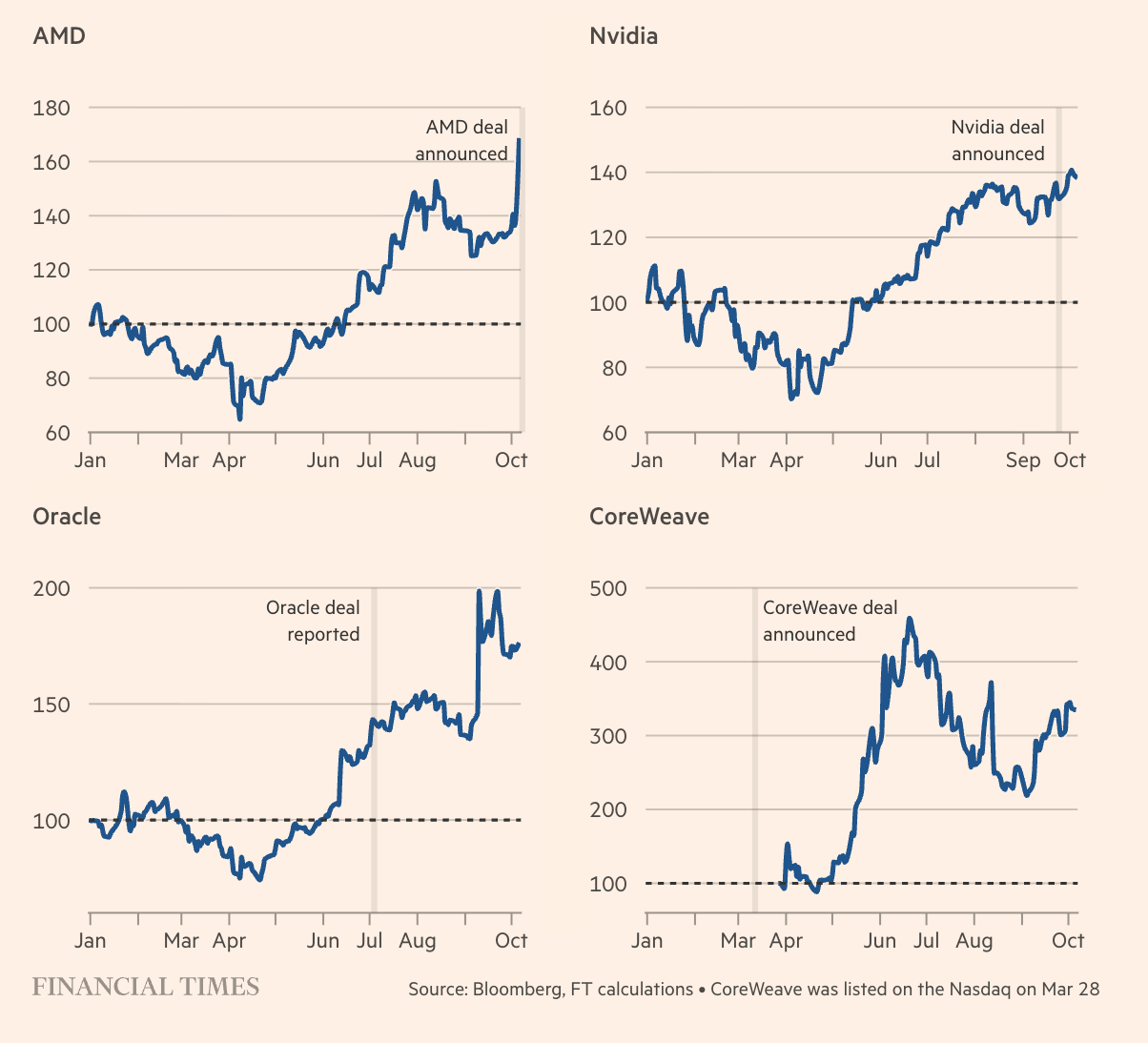

Source: FT

At the time of the announcement, all major companies saw their stock prices and market caps rise.

NVIDIA is profiting the most currently, as the most valuable company in the world.

However, once the hype subsides and analysts take a closer look at the data, a not-so-bright picture emerges.

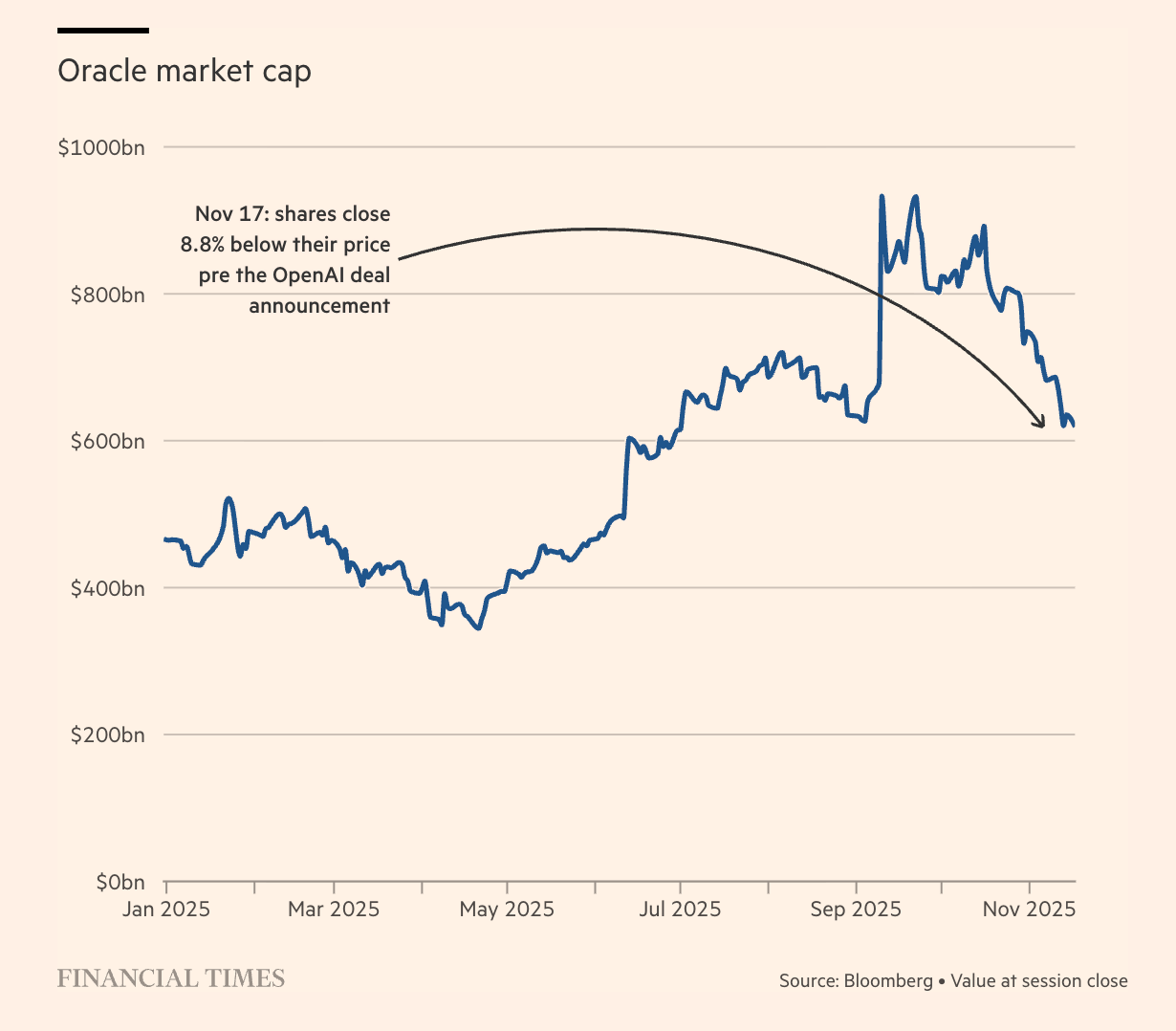

Source: FT

Especially with companies such as Oracle, which is loaded up to the tits with debt on its balance sheet, have since been on a downward spiral.

A similar picture emerges for NVIDIA, but because the demand for its chips is so strong, there is no need for them to worry at the moment.

All in all, the entire AI sector is betting on one company in OpenAI, and that is a risky move we have seen before with the Dot Com bubble.

It gets especially worse if you look at the U.S. GDP growth for 2025, where it did, in fact, grow by roughly 4.3%, but only because of AI.

Leave out the AI sector, and the U.S. would sit flat at 0.2% growth.

That’s a genuine concern, as the S&P 500 and other indexes become increasingly more centralized and rely on only a handful of companies.

Again, the comparison to 2000 couldn’t be more drastic!

When Is the Bubble Going to Burst?

This is the central question many analysts, including famous investors like Michael Burry, are asking themselves.

The simple answer is that no one really knows, as these bubbles often have a life of their own.

There are also people like Ray Dalio who go even further, arguing that these bubbles are healthy.

I find this a risky statement.

Sure, it’s healthy when you’re in on the deal early and can exit at the right time.

But in reality, most investors don’t have access to that information or even capital, and the hype surrounding these companies seems to be pushed daily.

I also blame the financial media, which, aside from a few exceptions, is pushing the same narrative as in 2000.

They’re not digging deep, taking a closer look at the deals, questioning whether OpenAI can meet its obligations, or even asking industry leaders whether AI is really as advanced as it’s being promoted.

Instead, they believe the marketing claims and push AI to unknowing viewers who might as well throw money out the window if the bubble bursts, and these companies are worth a fraction of what they are today.

No one knows what the future holds, but I think it’s safe to say that when the AI bubble bursts, it won’t be the same as the Dot-Com one.

It might just be bigger, influencing not only the tech sector but entire nations or regions that are going all-in on the technology today.

Sorry for the doomsday scenario and writing today, but it was worth it to share the entire story.

While AI is a great add-on and a new tool to make our lives more comfortable, it shouldn’t become the all-in solution to all of our problems.

After all, technology is only as good as the human input it receives…