Joël here! 👋

The past 24 months have been thrilling for you if you hold Bitcoin.

We saw the emergence of the spot Bitcoin ETFs in the U.S., along with a major wave of institutional adoption.

Next to that, Bitcoin has become a political topic and a point of contention. At this point, we’re even seeing announcements of potential strategic reserves on the state level.

Oh, and if that wasn't enough, we also witnessed Bitcoin casually obliterating every price ceiling known to mankind. At the time of writing, the latest conquest stands at just over $122,840.

You'd think that watching money multiply like this would have retail investors crawling out of the woodwork, especially during peak FOMO season, when Bitcoin becomes the dinner table conversation, even for your technophobe uncle.

Yet here we are, and the silence from Main Street is... deafening. It's almost as if retail investors have collectively decided that watching the creation of generational wealth from the sidelines is their preferred spectator sport.

I've got some thoughts on why the masses are sitting this historic run out—and why that's about to change in ways that'll make the last FOMO cycle look quaint by comparison.

It’s All About the Price, But Not the Way You Think!

For any Bitcoin maxi reading this, trigger warning: Bitcoin is all about Number-Go-Up (NGU)!

At least for normal investors and people out there who don’t spend countless hours on the topic.

If they read about yet another Bitcoin comeback in the news, most of them don’t check on-chain data or think in terms of a scarce asset.

Rather, they just see the number on the screen and think to themselves: Wow, that weird Internet thing is doing amazing. Maybe I should get some?

That’s what happens in an ideal world. But as you may know, the world is not perfect.

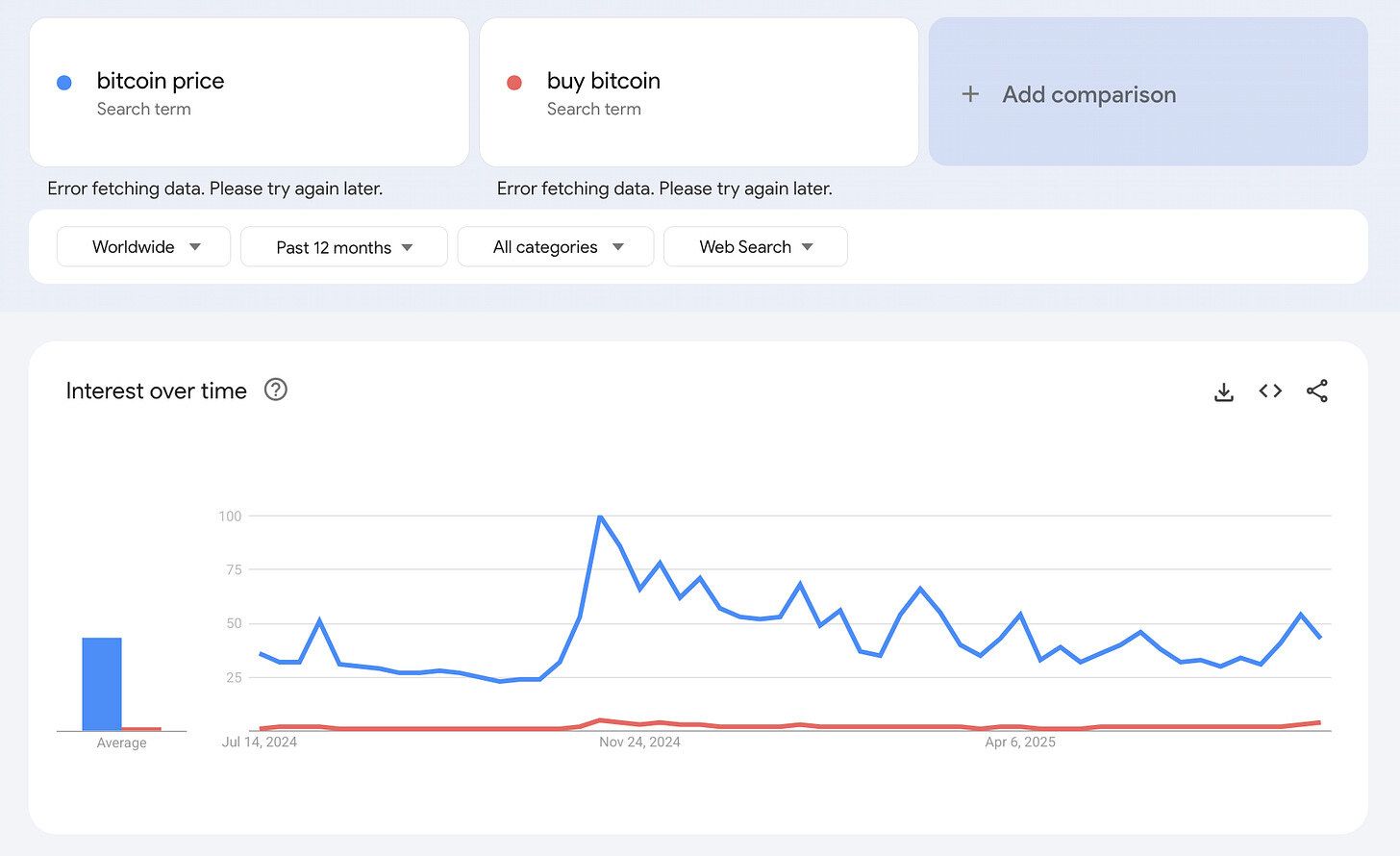

Source: Google Trends

In reality, as you can see in the image above from Google Trends, the interest in Bitcoin’s price and whether you should buy some is very low.

In fact, we’re higher in terms of U.S. dollar value per Bitcoin, but the interest in the price is lower than it was with the previous all-time high in November 2024.

Therefore, the theory that if the price is high enough, people will return to FOMO in Bitcoin is simply incorrect.

I would even argue that with Bitcoin trading at over $100,000 per coin, it seems like this is a major hurdle for everyday investors to overcome when considering investment.

Just like many before them, they feel that they have missed the boat and that it no longer makes sense to invest.

But there is more to this!

People Invest When the Pain Point Is Big Enough!

I’m not claiming to be a psychologist or behavioral expert, but I’m sure you’ve heard of or even experienced the "Too Good to Be True" heuristic.

Don’t know what this is? No worries, I’ve got you covered.

In simple terms, this is a common cognitive shortcut (or heuristic) in behavioural finance, rooted in skepticism and loss aversion.

Investors often apply the adage "if it sounds too good to be true, it probably is," which serves as a protective mechanism against scams or bubbles but can backfire on legitimate opportunities.

I did use some of my AI buddies to come up with a backstory to this, and it’s fascinating!

Under prospect theory (developed by Daniel Kahneman and Amos Tversky), people weigh potential losses more heavily than equivalent gains.

Which is something everyone who holds Bitcoin has also experienced at least once in their life!

You hear about it, maybe even get the basics of it all right away, but for some reason, it sounds too good to be true.

Rather than taking the first step, which can, by the way, be a small allocation you’re okay with losing, they neglect it.

But, I’m here to tell you that I’ve seen this in every bull market, and every time, there was a window, often before we turn into a bear, when retail investors allocate heavily.

This is when we often see the stupidity of advertisement online, celebrities getting on board, and sports arenas being renamed.

As a good rule of thumb, you can be sure that you entered the FOMO phase when everyone is texting you, or if cab drivers are also telling you about their allocation.

Most of these investors are also the first ones to sell if the price drops by 5% or more.

For most of these investors, the pain point of not being in on it — hearing their friends brag about the investment, or simply seeing billboards everywhere — is enough to make them cave in.

Additionally, they often invest if the pain point of losing out is so significant that they will invest solely to lose money again, and claim they were right all along.

I guess at the end of the day, everyone wants to be a Besserwisser…

So, Are Retail Investors Just Dumb?

Provocative headline, I know. Initially, this was the title of this blog post, but I thought it would be best to soften the blow a bit.

Obviously, retail investors are not dumb. The majority of them are driven by a healthy skepticism and a perpetual desire for a money-making machine.

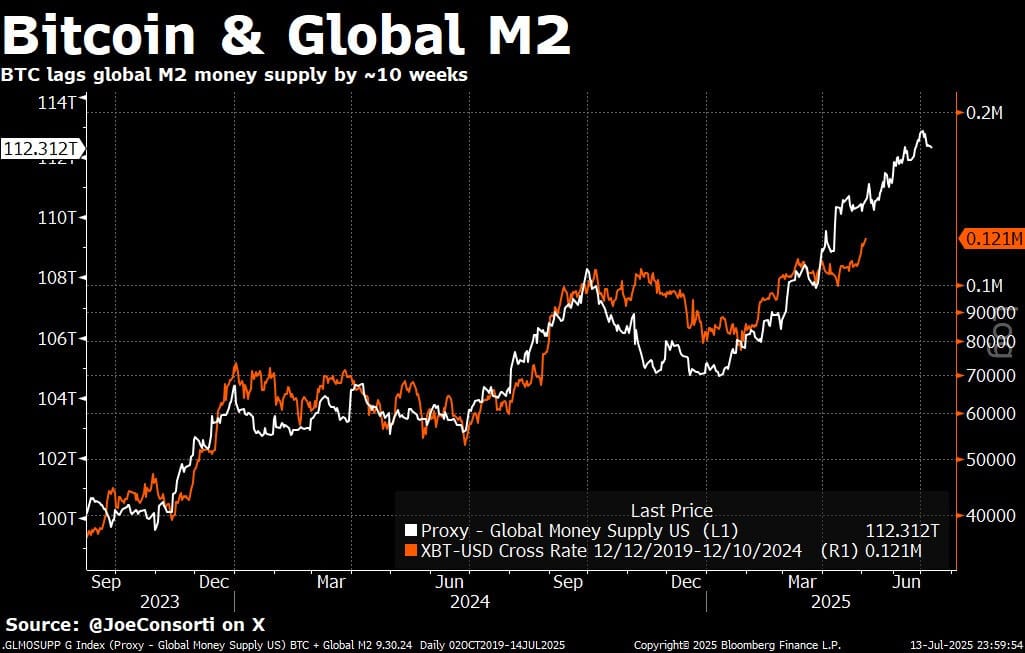

What I haven’t touched upon until now is the comparison between Bitcoin and other assets or single stocks in relation to the expansion of the global M2 money supply.

See, if all the central banks of the world, mostly led by the Federal Reserve in the U.S., are in crisis, they rely on a simple magic trick: printing more money to stimulate the economy.

During these times, everything seems to be going up. It doesn’t matter if it’s stocks, commodities, real estate, or even Bitcoin.

By having an economy that’s flooded with money, it’s easy to invest, become bullish, and drive buying pressure for anything up.

Source: X

Bitcoin has often profited from this, and there is an ongoing discussion among analysts about whether the correlation continues to hold.

However, that also means that other risk-on assets, such as growth stocks like NVIDIA, also benefit from this. In fact, they have actually shown a similar growth to Bitcoin over the past 24 months.

Speaking of NVIDIA, they have actually been one of the few companies during this bull run that continues to outperform Bitcoin.

Therefore, if you already have a wide selection of growth potential, why invest in Bitcoin?

If all you want to do is make money with some investments, wouldn’t you bet on the one horse that’s growing the fastest and actually giving you that gratification immediately?

Of course, you would! Which is why many retail investors are still allocating to the Magnificent 7, believing the hype, and continue to miss out on the boat with Bitcoin.

And once they realize that they should have bought some, they often go all-in and don’t allocate reasonably, but are driven by greed.

Like Gordon Gecko said: Greed is good, and we need to get more of it’

This seems like the tagline for retail investors during every Bitcoin bull market…

Retail Always Finds Its Way Back to Bitcoin

I don’t want you leaving here without some positive words of encouragement.

As I highlighted above, there are several reasons why retail is currently not interested in Bitcoin.

But if the past has been an indicator of what’s usually happening in the future, you can be sure that they will be back.

Personally, I think there are two scenarios that could happen and result in a major FOMO push by retail.

One is the price itself. The closer we get to $150,000, the more likely it is that many of them will come back.

The second scenario could be another major announcement by a big name or brand. We saw this in 2021 with Elon Musk and Tesla. We may see the same again.

Either way, retail will not be able to ignore Bitcoin.

Until then, take a break to relax and put the phone away. You will soon get the texts again asking if you can help them buy some Bitcoin.